Autodesk recently posted its Q1, 2022 fiscal financial results. The CAD giant reported quarterly earnings of USD 989 million, a year over year increase of 12 percent.

Key Financials

Autodesk touts its successful results driven by new business and its SaaS (subscriptions) licensing model. In fact, it says its subscription plan revenue was USD 948 million, accounting for 96 percent of total revenue.

Key Takeaways: Total revenue increased 12 percent to USD 989 million, for fiscal Q1, 2022. Subscription licensing model is performing with stable revenue base as more customers adopt cloud-based solutions in covid and post-covid contexts.

On a GAAP basis, operating margins were 14 percent, down 1 percent which is insignificant. On a non-GAAP basis operating margins were flat at 28 percent. Non-GAAP diluted EPS (earnings per share) were USD 1.03.

“An acceleration in new business, solid execution, and a resilient subscription business model delivered a strong start to the new fiscal year,” said Andrew Anagnost, Autodesk president and CEO. “As the world rebuilds after the pandemic, Autodesk’s purpose – a better world designed and made for all – has never been more important, and underpins our confidence this year and well into the future.”

In terms of segments Design segment revenue was USD 885 million for the quarter, an increase of 11 percent, while Make revenue was USD 82 million, an increase of 21 percent.

GAAP operating income was USD 134 million compared to USD 131 million in the first quarter last year.

Revenues by Product Family

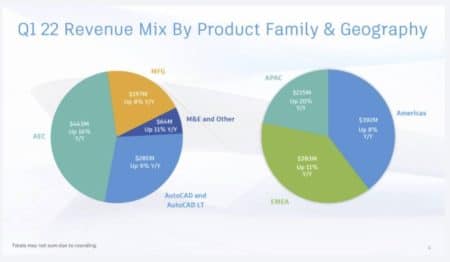

Autodesk breaks its revenues into product families—including AEC, AutoCAD, MFG (manufacturing related), M&E (media & entertainment related), and Other.

In the AEC family include Revit and related software and services, including all BIM 360 and all other AECO tools. AEC quarterly revenue was USD 442.6 million, up from 382.7 million a year ago, an increase of 16 percent.

AutoCAD-based revenue is substantial at USD 285.1 million, up from 262.2 million a year ago, an increase of 9 percent.

MFG-based revenue relates to product lines like Fusion 360 and Inventor and was USD 197.5 million, up from 182.9 million a year ago, a 8 percent increase.

M&E-based revenue relates to products like Maya, 3ds Max, Arnold, and its film-industry tools. Revenue for the quarter was USD 55 million, up from 52.6 million a year ago and representing a 5 percent increase. Finally, Other revenue was USD 9.3 million, up 75 percent from 5.3 million last year.

Revenues by Geography

Autodesk also breaks down its revenue by region. US based revenue was USD 324 million, representing approximately 1/3 of all revenues for the quarter. US revenue grew by 8 percent while Other Americas revenue grew by 10 percent to USD 67.7 million.

EMEA (Europe, Middle East, and Africa) revenues were largest by region at USD 382.5 million, up 11 percent from 344.8 million a year ago.

APAC (Asia-Pacific) revenues grew the largest of all regional revenues to USD 215.1 million up 20 percent from 178.7 million a year ago.

To learn more visit here.

Architosh Commentary and Analysis

As we can see in the chart above Autodesk’s revenue is approximately half in AEC. But AutoCAD revenue is also part AEC and AutoCAD ships as part of collections, including Product Design & Manufacturing Collection as well as its Architecture, Engineering & Construction Collection. This confuses the AutoCAD segmentation, the fact that collections include it as well. Is some part of “collections” revenue being attributed into the AutoCAD family revenue bucket, we would like to think so.

For Architosh readers wondering what is important about these financials let’s look at a few key trends. Firstly, Autodesk undertook the difficult transition from perpetual licensing models to subscription licensing models beginning in 2016. By 2017 there were going in deep on the SaaS transition. For fiscal 2016 Autodesk pulled in USD 2.5 billion. The following year their revenues fell to just USD 2 billion. It took them three years to climb back up to where they were before. With the transition behind them and with Covid now behind them (at least in the US and most of Europe which accounts for more than 2/3 of all revenues) Autodesk is well positioned for top-line growth.

AutoCAD continues to be a significant revenue generator and is growing year over year. Because AutoCAD is included in the “collection” bundles and those collections are smart value plays for many organizations, AutoCAD revenue seems fairly assured, despite the healthy amount of very good competitive offerings from the likes of Dassault and Bricsys.

The product line that seems interesting to watch is Fusion 360, especially with the recent acquisition of Upchain, a cloud-native product-data and lifecycle management platform. This brings PLM to the Fusion 360 universe, strengthening the Fusion 360 platform.

Autodesk’s Fusion 360 numbers continue to climb, now over 152,000 active subscriptions. Fusion 360 is the product that arguably must win away Dassault Systemes Solidworks users to reign supreme in the mechanical/manufacturing market. Fusion 360 is also the modern development template for the future of AEC apps and possibly Revit as Autodesk made clear to Architosh a year ago, as a smart cloud-connected thick app. So Fusion 360 is an interesting product to watch mature for various reasons.

MORE: AU20: Autodesk expands Autodesk Construction Cloud — New ‘Build’ and ‘Quantify’ offerings

Overall, Autodesk is well positioned for ongoing growth. Importantly, some of its construction industry applications become even more mission critical given the economic climate in construction materials costs. With sky-high materials costs in construction in the US, for example, being efficient with materials is more important than ever, as is the ability to track costs, compare alternatives, and stage work efficiently on the job site. This reality feeds well into some of Autodesk’s newest offerings.

Reader Comments

Comments for this story are closed