The Nemetschek Group has reported its fiscal Q2-2025 financial results and they are quite strong, with very strong revenue growth of 30.5 percent (currency-adjusted) and high profitability. The total revenue outlook for year 2025 has been revised upward.

2025 – Q2 Results

“Nemetschek continued its strong growth trajectory. We have once again recorded an extremely successful quarter marked by high dynamic growth,” said Yves Padrines, CEO of the Nemetschek Group. “Our innovative strength – particularly in the field of agentic AI – the consistent execution of our subscription and SaaS strategy, and our increased internationalization are the key drivers of this success. Despite growing global uncertainties, we are excellently positioned to continue generating sustainable and value-adding growth in the future.”

Nemetschek Group reports very strong 2025 Q2 financial results. Revises yearly totals to the upside.

Key financial summary data include:

- +30.5% revenue growth (currency-adjusted) in Q2 to EUR 290.0 million (this includes GoCanvas)

- +72.5% currency-adjusted growth in Q2 in subscriptions/SaaS offerings to EUR 208.5 million

- +38.7% ARR (annual recurring revenue) growth (currency-adjusted) in Q2 to EUR 1,078.3 million

- +46.3% EBITDA increase (currency-adjusted) to EUR 88.5 million, plus EBITDA margin expanded to 30.5% in Q2.

- Revenue outlook (currency-adjusted) increased to +20% – 22% for the full year in 2025.

The Nemetschek Group’s strong results reflect sustained momentum, driven by the shift from perpetual licensing to subscription SaaS licensing, as well as organic growth across key segments of its product portfolio. Additionally, the acquisition of GoCanvas is a significant contributor to revenue growth.

In the Design Segment, the company leveraged three-year SaaS contracts, which helped contribute to faster adoption of subscription license conversion.

Segment Notes

Design Segment

In the Design segment, the German company recorded strong growth at 16.7 percent, partially driven by stronger-than-anticipated demand for three-year contracts which were used to strategically incentivize transition to subscription SaaS licenses. EBITDA margin remained similar to last year at 27.2 percent.

Build Segment

This segment has significantly increased its revenue by 56.6 percent post business consolidation of the GoCanvas acquisition from 2024. The segment revenue was EUR 116.8 million, still quite a ways behind the Design segments revenue at EUR 260.1 million.

Manage Segment

Revenue in this segment was actually down at EUR 12.5 million, signaling that the Nemetschek Group needs to place more focus on this segment. The company, however, discontinued a low-margin consulting services unit in Q2, 2024, negatively impacting revenue.

Media Segment

Media segment revenue was modestly up 4.5 percent, to EUR 30.1 million in Q2. The subdued growth is due to the insolvency of a service and payment provider as it negatively impacted the first quarter results. EBITDA was still at 25.2 percent but down from the prior-year quarter at 28.4 percent.

Strategy Highlights

Strategically the acquisition of GoCanvas was positively material for the Group. So too were bolt-on acquisitions like Laubwerk for Maxon and Manufacton for Allplan. The Group also actively invests in promising startups, such as Handoff which uses cutting-edge AI technologies to streamline workflows for construction companies.

The company’s group-wide go-to-market strategy is symbolized in its Group-based mega booth for trade shows where the sister brands are all together driving synergies. The Group’s Agentic AI Assistant is also being gradually scaled across multiple brands and should strength product competitiveness.

To learn more read the full press release and our analysis and commentary below.

Architosh Analysis and Commentary

The Group’s earnings per share have reached EUR 0.84 (previous year: EUR 0.73), growing by 15 percent. This is well ahead of its 10.6 percent per year over the past five years. Additionally, EPS is slated to grow 18.5 percent per year. This is ahead of the industry average at 16.7 percent and the German market in general at 16.8 percent.

Nemetschek Group’s earnings per share (EPS), Revenues and FCF, etc. The Group is expected to reach EUR 2 billion in revenues by 2030 on an accelerated ARR path. (Image: Architosh / SW)

The forecast revenue growth is 12.7 percent, head of the industry at 11.1 percent growth and the overall German market at 6.2 percent. As a point of comparison, Autodesk’s EPS growth rate has been 17.25 percent, again well ahead of the industry it competes in, and ahead of Nemetschek. But Autodesk’s forward EPS rate is just 17.2 percent, a bit lower than Nemetschek.

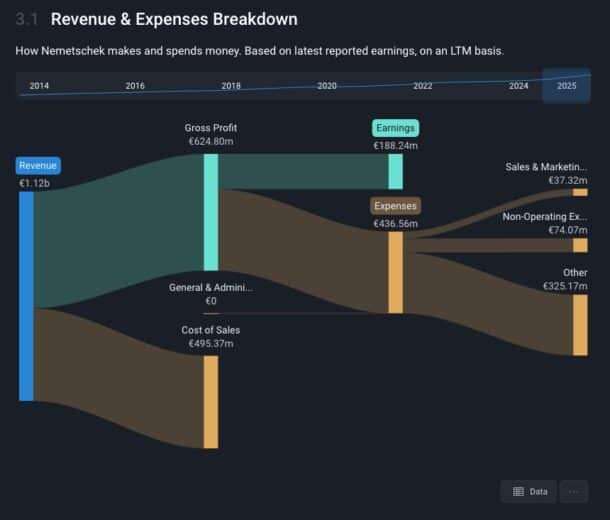

Nemetschek’s Sales and Marketing costs are EUR 37.32 million, or 8.5% of total Expenses. While Autodesk’s Sales and Marketing costs are USD 2.07 billion or 42.8% of Expenses. Autodesk’s Expenses are 82.% of its Gross Profit, while the Nemetschek Group’s Expenses are EUR 436.56 million (1/4 the size of Autodesk) or 69.9% of Gross Profit. These are interesting differences which can’t be fully explained by comparing the substantial difference in scale between these two companies.

Sales and Marketing as Percentage of Revenue

- EUR 37.32 million versus EUR 1.12 billion revenue, (or 3.3%) — Nemetschek Group

- USD 2.07 billion versus USD 6.23 billion revenue, (or 33.2%) — Autodesk

- USD 650.60 million versus USD 3.75 billion revenue, (or 17.3%) — Trimble

- USD 263.44 million versus USD 1.39 billion revenue, (or 18.9%) — Bentley Systems

The Nemetschek Group’s Sales and Marketing expenses are notably low as a percentage of revenue compared to its peers. Some analysts have noted how “moaty” the company’s software brands are in the world of software. The need for marketing, in particular, has tended to be lower as entrenched use of its products have meant existing customers continue to purchase upgrades. This is especially so for legacy users on Mac-based computer networks where rival products from Autodesk and Bentley have no Mac-based equal to consider. Another cost-savings on the marketing and sales expense-front are coming about through the Group’s new consolidated Group branding strategy.

The Nemetschek Group and its money flow diagram. The efficiency of the Group’s operational structure is highlighted in its remarkable trim Sales and Marketing expenses, dramatically less than its competitive peer group (Autodesk, Bentley, Trimble). (Image: Architosh / SW)

When Nemetschek shows up to AEC industry trade shows a massive Nemetschek booth contains nearly a dozen daughter brands in various formulations depending on the specifics of the trade show audience and industry segment. If the show is about infrastructure, the Nemetschek booth can be outfitted with Allplan, Scia and other engineering and construction brands like Bluebeam. If the show is about buildings and architecture the booth will hold brands like Archicad, Vectorworks and Solibri, among others. While the same number of staff must be attend shows whether in one booth or many, the efficiency of the single large booth and other consolidation factors likely streamline costs.

Despite Nemetschek’s long history of efficient operations and entrenched customers, a new fleet of BIM 2.0 software competitors will force the company into more aggressive M&A territory as well as increased sales and marketing postures to defensively keep its own customers to venturing off and testing the waters on exciting new products. At the same time, ongoing efforts to communicate Group-wide technology synergies like its AI technologies will need messaging delivered to its busy end-customers who are likely not getting the messages.