BENTLEY’S YEAR IN INFRASTRUCTURE 2020 was held virtually this year, following the pattern held by almost all conferences due to the global pandemic. In this article, we want to cover two primary themes, the first being a general summary of highlights on this year’s YII2020 conference and, secondly, a discussion about how Bentley aims to re-engage with architects in the BIM market with its OpenBuildings Designer platform.

Bentley YII 2020 Highlights

One of the key themes Greg Bentley made clear in his opening remarks this year was the importance of infrastructure resilience. This had new meaning this year, given the global pandemic’s impact on the entire world. Certain infrastructure—like digital communications infrastructure—became suddenly much more important, as the world’s population isolated at home and places of work in towns, cities, and suburbs largely became abandoned.

Many have said that ProjectWise was a saving grace for virtualizing their work in the world.

Bentley also noted that as a global software company, their own transition to work-from-home orders went seamlessly as they are already accustomed to working remotely amongst their various teams worldwide. They took that expertise and applied it to their customers to help them better transition to work-from-home (WFH) methods and workflows. “Many have said that ProjectWise was a saving grace for virtualizing their work in the world,” said Greg Bentley during his Media Day remarks. In fact, Bentley offered the most generous and extended trial of ProjectWise 365 during this year’s pandemic, taking free use from the spring time-frame all the way into the fall.

Economics

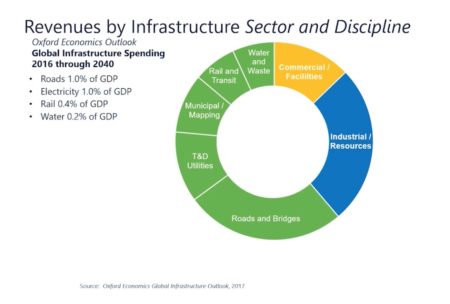

This year Bentley went public (only several weeks ago) and is now traded on the NASDAQ under the stock ticker BSY. As such, the company revealed market segment financial data as part of its communication to investors. As you can see from the first image below, Bentley’s Commercial / Facilities sector—which the company refers to as “vertical infrastructure” extends from the 12 o’clock position to about the 1 o’clock position, making up about 1/10 – 1/12 of revenues by all sectors. Greg Bentley referred to this segment of their revenue as “relatively small.”

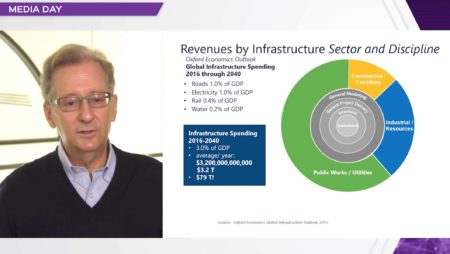

A slide from Greg Bentley’s Media Session, breaking down the company’s revenues by infrastructure markets. On the third slide we indicate which markets Bentley says it is the market leader. (Image: Bentley)

The next sector, Industrial / Resources, relates to the energy and commodities markets and is “exposed to cyclicality,” as Greg Bentley noted. The next sector is actually part of a larger public works sector and that is Roads and Bridges (what the company lumps into their “horizontal infrastructure” category), which makes up slightly more than twice the revenue as vertical infrastructure category where buildings and facilities live. Bentley’s next sector is T&D Utilities (electric transmission and distribution), Municipal and Mapping, Rail and Transit, and Water and Waste are the final sectors. As you can see, the green sectors are all part of Public Works & Utilities and makeup approximately 60 percent of their entire revenue. (next image)

A slide from Greg Bentley’s Media Session, breaking down the company’s revenues by infrastructure markets. (Image: Bentley)

Bentley’s public financial numbers state the global CAD giant posted revenues USD 737 million in 2019, a 6.5 percent increase in growth compared to 2018. Gross profit was USD 593 million. Bentley’s EBITDA margin is 28.12 percent, beating a sector median of 12.67 percent. It is a very efficient company in terms of its employees with net income per employee at USD 31.28 thousand, besting a sector median of 7.97 thousand. The stock IPO’d at USD 22.00. As of this writing, it is trading at USD 36.93.

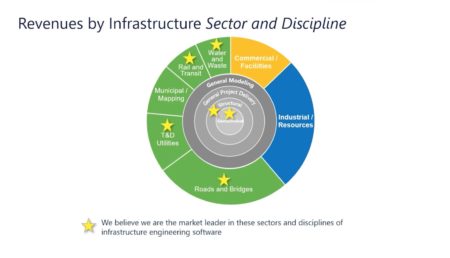

Greg Bentley stated that Bentley believes they are the world leader in software technology for the global infrastructure market, with sector leadership in Roads and Bridges, T&D Utilities, Rail and Transit, Water & Waste, and in the structural engineering disciplines and the geotechnical engineering disciplines generally.

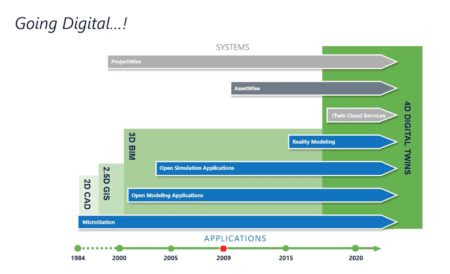

Bentley began with one application, the CAD application called Microstation, in 1984. That application in the United States and other western markets like the United Kingdom captured significant market share by the 1990s in the AEC industry, competing head-on with Autodesk’s popular AutoCAD. By the start of the current century, and with the BIM market blooming around the high-profile Autodesk acquisition of Revit by Autodesk, Bentley began to focus more on horizontal infrastructure, becoming the world leader in CAD technologies for transportation departments in many countries, including the United States. (see image)

A slide from Greg Bentley’s Media Session, showing the evolution of products and technology at Bentley Systems over the past three and a half decades. (Image: Bentley)

Their Open Modeling application tools began in the early mid-years of the aughts decade, taking the company into the BIM market for AEC. Open Simulation applications came next, and then AssetWise emerged to help their clients manage infrastructure, a key new source of revenue after the Great Recession decreased global infrastructure spending. In 2018 they announced iTwin Modeling after Reality Modeling technologies also emerged. All of these vectors of tools and technologies have enabled the company to offer a complete stack for 4D Digital Twins, leaving the company very well positioned for the next wave of global infrastructure and smart infrastructure investments.

Markets and AEC

Greg Bentley says that his company’s strong suit is its “comprehensiveness.” Other competitors may have strong single or multiple applications addressing various parts of the infrastructure market, but only Bentley has this full stack of solutions. Larger companies like Hexagon, Trimble, and Autodesk offer a far less complete set of infrastructure solutions. And Bentley is a leader in “structural and geotechnical engineering software” that compliments infrastructure design software—whether horizontal or vertical in nature.

In some ways, Bentley is similar to Germany’s Nemetschek Group. Both companies make approximately the same amount of revenue with similar gross margins. While Bentley’s focus and strength and revenue are more on its “horizontal infrastructure,” the Nemetschek Group’s focus is more on “vertical infrastructure.” Both companies own leading engineering analysis tools for structural engineering, and both have solution portfolios focused on the management of infrastructure assets. A small difference with each company is that Bentley has just gone public while Nemetschek has been a public company for much longer and has seen substantial growth in its stock price.

A slide from Greg Bentley’s talk to the media. Sectors with “stars” are where the CAD giant feels it has market leadership. Roads and Bridges is the largest revenue sub-sector within Public Infrastructure for Bentley. They have software tools (grey) that apply to each of the three major sectors and it is not clear how much revenue from these applies to each. (Image: Bentley)

In the wake of the Revit Open Letter in the UK, I asked the company to discuss its position in the architecture market. Building design and engineering all fall in their “vertical infrastructure” category. Given the Revit Open Letter’s timing and that, nearly all of the large AE firms who signed the letter were, or are, Bentley customers, it seemed appropriate to discuss with Bentley where its OpenBuildings Designer application is headed and if Bentley has any interest in re-attacking the architecture market. It turns out it does. But before we get to that, let’s recap some of the highlight news from Bentley’s YII 2020 conference.

One final point, though. Greg Bentley noted that 30 percent of the world’s infrastructure expenditure comes from China, while 50 percent comes from Asia. It is not surprising then to see the sheer amount of projects submitted for its YII awards program coming from this region of the world. From the image above, we can also see that the global infrastructure market is worth USD 3.2 trillion, while Roads and Bridges are worth 1 percent of global GDP, and Rail is worth 0.4 percent of global GDP. Using 2019 global GDP, that amounts to 1.42 trillion and 0.56 trillion, respectively. From 2016 until 2040, the infrastructure market is worth USD 79 trillion.

Announcements at YII 2020

This year, there were several interesting announcements, including items we have already covered on Architosh, such as its finalists and winners of its Year in Infrastructure Awards, the appointment of three new key executives, and Bentley expanding its alliance with Microsoft to accelerate infrastructure digital twins. You can read all about these at the links just provided.

The first of these interesting announcements was about FutureOn, a fast-growing Norwegian software company with a growing global customer base of energy giants. It has secured an investment from Bentley’s Acceleration Fund and partnered with Bentley to combine FutureOn’s award-winning field design app (FieldAP) and its API-centric collaboration platform (FieldTwin) with Bentley’s iTwin platform. This will give joint customers a next-generation digital twin solution. You can read more about that here.

Another announcement was that Bentley and Siemens Energy are now offering a joint solution to deliver intelligent analytics to oil and gas operators. This solution should help equipment uptime and reliability while reducing the cost of maintenance and safety risks. The new solution is known as Asset Performance Management for Oil & Gas or APM4O&G and taps the power of AssetWise. You can read more about that here.

next page: Bentley and Architecture

Reader Comments

[…] subsequent web page: Bentley and Architecture […]

Comments are closed.