THE ROMAN EMPEROR Marcus Aurelius once wrote, “Everything we hear is an opinion, not a fact. Everything we see is a perspective, not the truth.”

In the current moment, both politically and culturally, Aurelius’ words seem apter than they did in recent decades. But they have always carried a particular value within the global CAD industry—if not the computer industry as a whole—where opinions of market share and technology leadership curse and stain the canvass of the technology world in a way that ultimately limits the end user and progress itself.

Nothing is more corrosive to progress and innovation than distorted amplitudes of opinion. Especially the kind that has injured the industry as a whole by leading the masses into the false notion that the CAD industry is ultimately a “death-match,” a winner-take-all type of a game.

From the Banks of the Danube

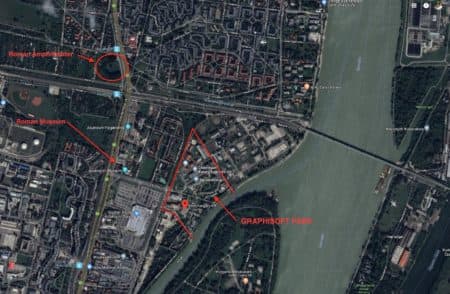

The good folks working on the western banks of the Danube river, at GRAPHISOFT PARK, just a bit north-west of downtown, have long known the truth about the AEC CAD industry. For years often type-cast as the “David” in the David and Goliath story within the BIM software world, GRAPHISOFT has been helped along in this knowledge by working closely with its mega-sized customers (which the company refers to as “clients”).

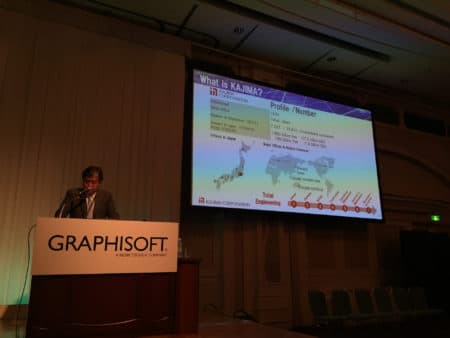

Within the context of Japan’s “partnering culture,” a legacy carry-over from the history of keiretsu enterprises, the Hungarian software leader has established a key partnership with Japan’s largest AEC companies, including Nikken Sekkei, Kajima Corporation, Maeda Corporation and others. It’s in working with Japan’s AEC Goliaths that the false perspectives generated in the West, particularly in America, come to light.

MORE: Why one of Apple’s most notable developers is winning big in Japan

The fact is this: the AEC industry is far too large for any one software company to serve—not just adequately but supremely—and with the proper attention to the forks of innovation that any one particular segment of AEC users demands.

From GRAPHISOFT’s perspective, this challenge has been addressed in multiple ways. Perhaps in taking cues from its key clients in Japan, it has chosen to partner rather than code in addressing the algorithmic design innovation fork. The results of this decision have been powerful; McNeel’s uber-popular Rhino and Grasshopper programs provide a direct thoroughfare to next-generation designers both in and outside of architecture school.

02 – GRAPHISOFT PARK is a beautiful small park actually. This view across a pond looks onto two Microsoft buildings.

Meanwhile, the operability challenge continues unabated with multiple OPEN BIM initiatives, recently helped along by industry giant Autodesk with its own statements, actions, and technology plans.

From Aquincum to GRAPHISOFT PARK

Marcus Aurelius, known as the last of the so-called Five Good Emperors, partially wrote his famous “Meditations,” decamped on the banks of the Danube. And GRAPHISOFT PARK, itself is just hundreds of meters from ancient Roman Aquincum. There you will find the ancient stonework of a modest-sized Roman amphitheater, one of two located in Obuda, Hungary.

Nowhere can man find a quieter or more untroubled retreat than in his own soul.

I see a kind of soft connection between the Hungarian BIM maker and Aurelius, beyond the common soil they both have walked upon. The Roman Emperor possessed a sureness of personal course and place in the universe that his “Meditations” tell us was based on a Stoic self-analysis system of personal conduct within a larger order of things.

It has not gone unnoticed by this author that it can’t possibly be easy for GRAPHISOFT, who according to most accounts is the first developer shipping a commercial BIM application for personal computers, to have to endure the occasional indignity in the United States of having AEC users miss-associate BIM with Revit. Perhaps Aurelius’ words from Meditations offer some council: “Nowhere can man find a quieter or more untroubled retreat than in his own soul.” Aurelius also notes, “put from you the belief that ‘I have been wronged’, and with it will go the feeling. Reject your sense of injury, and the injury itself disappears.”

03 – A view of GRAPHISOFT PARK from the sky. It is directly adjacent to the ruins of the ancient Roman town Aquicum. An amphitheater is largely intact (upper left corner).

As comforting as the words from “Meditations” are, it is patently incorrect to believe that GRAPHISOFT’s rival in Autodesk hasn’t benefitted from perspectives that clash with facts. Yes, Revit is a BIM app, as is ARCHICAD, as are many other apps. But BIM is not Revit.

Borrowing From Steve Jobs’ Playbook

GRAPHISOFT is a company unconcerned about dealing with perceptions. They would rather deal with facts, truths, and technologies. If any of the leadership at GRAPHISOFT has read any of Marcus Aurelius’ “Meditations” they know how important patience and tolerance are and that all things come to an end. Life is a cycle; things change.

Nobody knew change and cycles better than Steve Jobs. And Jobs, as sort of a spiritual mentor or hero figure for the company, as well as one of its key angels in the early ’80’s, certainly plays a role for the company. A bronze statue of the Apple founder graces its entry at GRAPHISOFT PARK. What Jobs offers the world then and now, regarding how he thought, is a mental picture of what is required to innovate and lead the industry, not follow it. There is an intense focus at GRAPHISOFT that is very Apple-like. This is a company that knows the Jobsian-value of saying the words “no” as in the decision to not code their own algorithmic modeling tools but instead partner with a best-in-class leader.

04 – Jobs saw an early version of ARCHICAD on the Apple Lisa computer in Germany and became a supporter of the company from that moment on.

GRAPHISOFT’s focus has led to numerous market-leading innovations and patented technologies. BIMx, its mobile app, is the first such application to bridge the divide between drawings and BIM models in a way that a non-industry professional can understand. While rivals have copied some of its innovations, it mostly remains in a class by itself. ARCHICAD was the first BIM tool to be genuinely coded to take advantage of the multiple cores in today’s CPUs, in non-rendering and everyday workflow tasks. And its patented Delta-Server technology in its BIMcloud offered the industry the first truly scalable, real-time global collaboration capability.

There is an interesting lesson lingering in the bronze statue of Jobs. For years Apple made the best GUI-based personal computers while another rival took the lion’s share of the market. What eventually broke this dynamic between Apple and Microsoft was massive industry transformation and new types of products serving that transformation. The AEC industry is in the midst of a new wave of change around a new level of holistic (beyond BIM) collaboration. Could this be the period where the Hungarian software maker breaks away from the pack?

In the rest of this article, we’ll delve into where GRAPHISOFT sees itself within this new wave of change and what may be coming next for it.

Takeaways From Kyoto, Japan

With or without changing perspectives about BIM in the United States, GRAPHISOFT’s innovations will continue. It’s latest version 21 of its ARCHICAD BIM application lays testament to this. And it will also continue to grow its market share and user base, around the globe.

Let’s look at some key takeaways from the 2017 KCC event in Kyoto, Japan, held back in June.

Macroeconomics—Growth and Alignment

In Kyoto, at the GRAPHISOFT Key Client Conference (KCC), Viktor Varkonyi, CEO, led a talk where he showed that in Asia over the past year the company had 42 percent growth, likely the result of agreements and partnerships in greater Asia the company put in place a few years ago. In the same (2016) year growth in Europe reached 21 percent, while in America growth topped 27 percent in the previous year.

06 – An image of a slide from the 2017 KCC in Kyoto. The company had stellar growth in Asia in 2016.

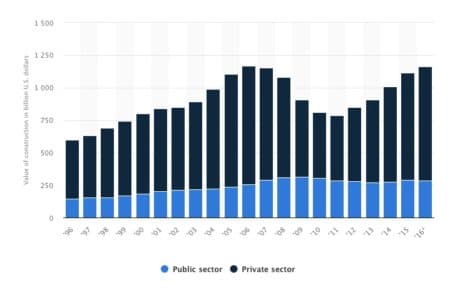

There are some remarkable aspects to this growth story. The first highlight involves the worldwide Great Recession, tipped off in 2008. This slowed global construction spending, which plummeted in 2009. The US construction industry reached its bottom in 2011 before heading back up on its steady rise. (see image 07). During this period GRAPHISOFT had steady growth in the region.

Some may argue that while the company’s growth has been good it is greatly overshadowed by Autodesk’s Revit usage in the US AEC industry. This is true of Autodesk’s other rivals as well. However, the US’s construction market isn’t the only massive market. When the US construction market hit bottom in 2011, it was worth $788.US billion. It is predicted to reach $1.3US trillion by 2019. And Japan is predicted to reach $691.US billion by 2019. Japan’s construction market in a few more years will be 87 percent the size of the US’s market in 2011.

Japan, however, is a country with a declining and aging population, falling faster than expected. (Japan’s 2016 population is 127 million, compared to the US’s 323.1 million). While Japan’s population is roughly one third (1/3) the size of the US, Japan’s construction industry is roughly one half (1/2) that of the US’s construction industry. They spend more, are highly urban, and Prime Minister Shino Abe has ambitious infrastructure plans, including their upcoming spending for the 2020 Tokyo Olympics.

GRAPHISOFT’s successes in Japan are being leveraged throughout Asia, and this was keenly witnessed at the Kyoto conference earlier in the year. A report by BMI Research back in 2015 stated that according to their analysis, Asia would cement its position as the world’s largest construction market, with Asia overall reaching nearly $3.US trillion by 2024. Within Asia, the big three construction markets include China, Japan, and India.

08 – Japanese giant Kajima Corporation is one of those companies firmly behind ARCHICAD as their BIM platform, and the company is branching out throughout Asia and the world.

And let’s not forget to look at Europe. According to a report by Euroconstruct.org, 2014 marketed the year the EU rebounded, with construction spending expecting to reach 3.euro billion in 2018. On a country basis, the biggest construction markets are Germany, followed by France, the UK, and then Italy. Those four countries combined had 2014 construction output of 825.euro billion, with a combined group population of 275 million.

With global construction growth from 2017 – 2021 now expected to average 2.8 percent, and with the construction value in the emerging world now ahead of advanced economies (since 2014), GRAPHISOFT has ample opportunity to leverage its strong base of growth in Asia. This means in real terms, modest growth in the US market will hardly dampen the company’s overall global performance. And the company is already a leader in Europe, which itself is a very large construction market.

Running through this economics is essential, particularly for the audience in the United States, where “perspectives” tend to be too US-centric or non-global. GRAPHISOFT isn’t just an innovation leader; it is strategically aligned in key global markets that are either already sizeable, rapidly growing or both.

Future Directions

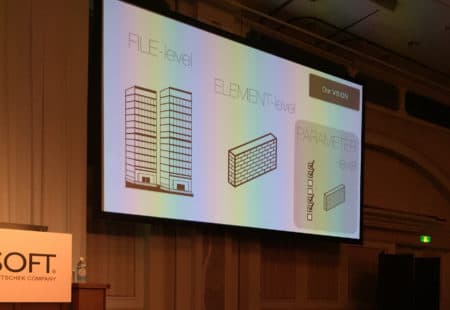

In Kyoto, GRAPHISOFT CEO Viktor Varkonyi, laid out a vision of the future in broad brush terms. One slide in particular captured the three main thrusts of this vision. (see image 09)

The first thrust of this vision is already well underway and is focused on bringing ARCHICAD to the front-end of the design process by linking it to algorithmic design tools in Rhino + Grasshopper. Both marquee design firms and significantly large AE firms (like Nikken Sekkei) utilize Rhino + Grasshopper to address and solve all kinds of unique challenges by tapping the power of algorithms. Varkonyi stated in Kyoto the company wanted to expand in this area with GDL-level parametric control. The latest news from just a week ago marks the first time Grasshopper can be used to create GDL objects.

To address the needs of marquee design firms even further, we see GRAPHISOFT deepening its link to McNeel’s two programs—Rhino 3D and Grasshopper.

Both ARCHICAD and BIMx are slated to address the needs of the construction industry, said Varkonyi in Kyoto. This meets the present and emerging needs of its large Asian customers (clients). This does not mean there will be dedicated engineering or construction solutions but rather specific capabilities built into both apps in the future. BIMx, in particular, will become an information access platform in its own right, via an API. This means other data sources can stream into BIMx, other than BIMcloud.

And the third major thrust as part of its vision for the future has BIMcloud and Bluebeam serving critical roles throughout all phases from predesign through operations. With Bluebeam’s Studio technology emerging as the CDE (common data environment) tech stack for the Nemetschek Group, we could see BIMx also streaming in data from Bluebeam’s future CDE. Imagine, not just being able to go from BIM model 3D view to 2D drawing within BIMx, but also being able to directly go to Bluebeam Revu versions of that drawing.

If a construction supervisor from Kajima in Japan needs to view a drawing and relate it to the BIM geometry model, using a future version of BIMx, he could bring up the drawing and then invoke a Bluebeam Revu markup session as one way to address comments on the drawing (especially once construction has started). These comments might be an RFI for the architect to address. Likewise, if the same person needs to address a question in the BIM model, he may invoke the BCF process in BIMx, sending the comment and the 3D relationships to the comment, to an estimator or fabricator who is working in a BCF-compliant BIM package. These are possibilities for where BIMx can go.

10 – First files, then elements now parameters. A vision of progress suggests an “atomization” of, not the BIM process, but the AEC collaboration process.

In a special lunch with the press session in Kyoto, Varkonyi stated he felt that a successful CDE solution by the Nemetschek Group needs to be a web-based solution. As stated here, Bluebeam Studio is a desktop and mobile solution with a cloud-connection. That is not the same as web-based. Procore, a growing CDE in the US construction market, is a web-based solution. Architosh already broke a story about Bluebeam opening up a Boston office and recruiting staff charged with building web applications, presumably a web-based version of Bluebeam Revu.

Atomizing BIM

Varkonyi explained in Kyoto that the evolution of AEC collaboration worked first as “file-based” collaboration, then with Teamwork, it became “element-based,” and in the future, they will go down to a “parameter-based” vision of collaboration. The error of synchronizing multiple BIM models is over. Instead, teams will collectively build a real construction model.

If you atomize the virtual building down to the parameter level, and you allow APIs to talk to each parameter, and other apps and systems can communicate through those APIs, then what you have is an entirely new approach. Varkonyi referred to this as a “digital backbone for the entire AEC process,” from architect to the owner-operator.

Reader Comments

Comments for this story are closed