Ever since German-based Graebert beat Autodesk to the punch to deliver a new MacOS native version of a DWG-native CAD program, the Berlin-based ARES CAD ecosystem has been locked in an epic market battle with US-based Autodesk for dominance in the DWG CAD market.

This week, Graebert hosts its neXt event online for free, where CAD users worldwide can see what is new in the company’s ARES-branded CAD offerings for desktop, tablet, mobile, and web browser CAD. You can register here.

DWG Matters

Two recent discussions with major AEC software companies outside of the DWG CAD market have revealed some interesting statistics about the nature of 2D CAD in AEC in an era where BIM has been favored for at least a decade. One company remarked that DWG (sometimes just referenced as AutoCAD) still has about 40 percent of the market for the primary delivery tool for drawings for the AEC market (this was focused on architecture and engineering firms. Construction firms use even more AutoCAD and DWG alternatives.)

MORE: Graebert neXt Event — What’s next in DWG CAD

While the stat is anecdotal, the world’s largest provider of visualization technologies in the AEC market knows a thing or two about what its customers are using. Stats that show BIM penetration in global markets also reveal that 2D CAD is still highly dominant in many regions of the world, including rapidly advancing countries like Southeast Asia and India.

Autodesk’s own efforts behind advancements in AutoCAD seem quite robust for a technology that was supposed to be pushed to the side in the era of BIM. And that is because 2D CAD still matters a lot. 2D CAD information on the job site, whether printed or on screens, is the primary way in which the AEC world gets built.

A Fierce Battle Front

Graebert’s development efforts with its native DWG ARES have been impressive for well over a decade and a half now. A common attendee of its in-person Graebert Annual Meetings in Berlin, Germany, Architosh has followed the ARES ecosystem’s development in detail for years. At the same time, we have consistently detailed each year’s AutoCAD updates, making note of key achievements like the first emergence of AutoCAD Web and interesting technologies like its Trace Layer features. (see: Architosh, “Autodesk Releases new AutoCAD 2023 Product Line,” 30 Mar 2022)

A chief advantage ARES has long had over AutoCAD has been on price. It is vastly less expensive. However, Graebert executives don’t like it when the press touts this, which is notable because the truth is they love touting their innovation leadership over Autodesk instead. The Berlin-based CAD company was faster to market with not just a Mac version of a native DWG CAD program, but also delivered better apps for tablets and smartphones. (see: Architosh, “Is ARES the neXt AutoCAD?” 22 Mar 22)

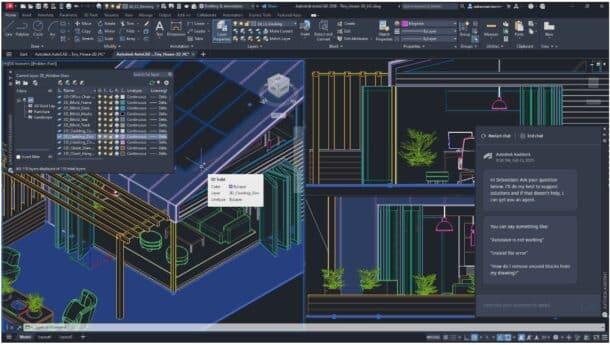

The path that Autodesk took in reference to its DWG competition has been interesting, to say the least. While not first to the Mac, the company has certainly leveraged more unique Apple technologies in its Mac versions of AutoCAD and LT. An Apple keynote once showed off how powerful AutoCAD ran on iOS, though that was more a testament to Apple’s ARM chips than anything else. Still, the California-headquartered CAD company showcased an interesting approach to markup with its Trace Layer technologies several years back that continue to pickup more value (see: Architosh, “What’s new in AutoCAD 2026,” 17 Apr 2025)

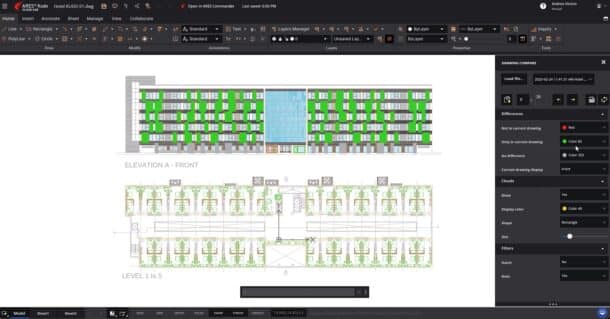

Meanwhile, ARES Kudo, the version of ARES that runs in a web browser, has essentially matched AutoCAD LT in features yet delivers cloud-based advantages because it is browser-based. Where AutoCAD has leaned into dominant personas and use-cases for its web and mobile versions of AutoCAD, the folks behind ARES are pushing ARES Kudo into an “alternative” path to full-featured CAD, just through the flexibility of a brower-based workflow. (see: Architosh, “Product In-Depth: ARES Kudo 2025 —Takes Aim at AutoCAD LT,” 27 Mar 2024)

A final view of the Drawing Compare features in ARES Kudo. Kudo now has BIM to 2D Drawing capabilities that greatly advance its utility.

While AutoCAD itself has its many industry sector specialized toolkits (eg: mechanical engineering, architecture, etc), ARES has not attempted to mirror AutoCAD one to one across such offerings. It does, however, offer ARES Mechanical focused on 2D mechanical plans. And unlike AutoCAD where deeper BIM integration requires AutoCAD Architecture, ARES Commander has BIM integration natively.

Another differentiator between ARES and AutoCAD is that Graebert has tailored its solutions for large enterprises and in doing so has won over massive AEC and manufacturing companies in Japan and South Korea. This article here discusses some of the organizations that have made the switch to ARES due to both enterprise features unique to ARES and licensing benefits in favor of German CAD company.

Trendlines: ARES vs AutoCAD

When it comes to pure technical prowess, Dr. Robert Graebert (PhD. from Stanford University) leads a formidable team of software engineers and computer scientists back in Germany in Berlin and worldwide. He is also chairman of the Open Design Alliance (ODA) and has been since 2011.

In broad strokes the ODA (a consortium of CAD software companies) have succeeded in reverse-engineering the proprietary DWG file format such to establish reliable and technically equivalent DWG read-write file format compatibility. Nearly all non-Autodesk CAD companies use these member-available software libraries to be make their CAD programs compatible with AutoCAD in terms of read and write capabilities.

Unlike most CAD programs with their own unique proprietary file formats, ARES CAD software uses its version of the DWG file format natively. Unlike so-called AutoCAD clones, ARES’s CAD ecosystem offers unique features and technologies. ARES and AutoCAD are thus not carbon copies of each other.

Trends in Product Direction

Overall trends show that Autodesk has doubled down on AutoCAD Architecture, MEP and Electrical toolkits while advancing AutoCAD to be more tightly integrated into its vast network of applications serving its Autodesk Construction Cloud and Fusion 360 domains. It is also focusing on the exploration of AI-driven design automation, such as its continued work with “blocks” and insights for user-tool intelligence. Autodesk also taps into leveraging unique Apple technologies from time to time with its MacOS versions of AutoCAD.

On its core technologies front, Autodesk also leverages graphics and 3D modeling technologies that are new developments cutting across multiple product sectors at Autodesk. It has also been quick to latch onto leveraging graphics technologies from Apple for its MacOS versions.

ARES Touch has been a key differentiator for Graebert along with its unique enterprise features helping large AEC companies in Japan and globally deploy DWG technologies in field to office methods that are wholly unique to Graebert.

For ARES CAD the German software company continues to focus on cloud and AI with more powerful, flexible and less costly licensing technologies and offerings. Graebert has focused more on advancing its mobile and web (cloud) versions of ARES Touch and ARES Kudo, respectively, as both tools have been strong components of utilization by major large AEC organizations in Japan.

On a core technology front, ARES continues to leverage ACIS-based solid and basic assemblies for its 3D technologies while development of core OEM solutions has meant that ARES technologies have diffused throughout larger CAD companies such as Dassault with its DraftSight product line and PTC with its Onshape Drawings (a cloud offering that competes with Fusion 360). ARES is also uniquely available for Windows, Mac and Linux, though actual use levels on the Linux platform are likely small.

BIM and AI

Both companies are focused on artificial intelligence (AI) and finding useful ways to leverage the emergent technology. Autodesk has a small lead in AI integration using the technology to identify common objects and speed their development into intelligent blocks, among other AI features.

On the BIM front, ARES technology has an entire BIM to 2D Drawing feature set that is growing in sophistication. First released on just the desktop, its emergence this year in ARES Kudo in the cloud means a whole new world of possibilities open up for Kudo users. ARES can ingest Revit and IFC BIM models and automatically generate floor plans, exterior elevations, and building cross sections, complete with auto-dimensions, auto-room names, door and window symbols and tags and more.

ARES’ push into the world of BIM is unique as it aims to fulfill a new trend in BIM 2.0 towards what is known as “auto-drawings” whereby even schematic level BIM models can automatically be ingested and spit out useful 2D drawings. This technology can help serve the utilization of some of the new BIM 2.0 upstarts in AEC like Snaptrude and others who are variously engaged and partnering with the German CAD company.

Closing Comments

In the first decade of this century, Autodesk’s main competition to the ubiquitous AutoCAD (in AEC) was the BIM movement with its own Revit BIM platform. The idea was that architects and engineers would make virtual buildings in the computer and slice them for views (drawings). Any remaining 2D drafting work would take place inside Revit itself with its foundational drawing toolsets.

However, not all AEC professionals adopted BIM and Revit. Furthermore, legions of mid-career AutoCAD professionals remained on their often first and only CAD tool or migrated into part-time CAD user personas as they moved up in management roles. Moreover, AutoCAD continued to advance, even flourish. Emerging markets in countries like India and Brazil grew their CAD bases as industrialization in those regions advanced. It was often in these regions that Autodesk faced tough competitor pressure from companies like Germany’s Graebert.

Back in more advanced economies like North America, Europe and Japan, the competitive pressure between ARES and AutoCAD has remains intense. Autodesk has been advancing AutoCAD at a steady pace as it cannot rest for even a moment in the face of pressure from rivals, and not just ARES. BricCAD, which was purchased by Swedens’s massive Hexagon AB, is another serious competitor to AutoCAD and now part of Hexagon’s HxGN SMART Build end-to-end AEC ecosystem.

At this present time the DWG CAD market is as interesting as it has ever been and will likely to continue to evolve in unexpected ways given new trends such as auto-drawings, AI and the future of BIM in the cloud.

ARES neXt Event

For those wanting to learn more about ARES the German CAD company’s annual virtual product update event starts tomorrow. Interested readers are encouraged to attend to the free virtual ARES neXt event.