Continued from page 1

ARM, Apple, and Intel

In the latter half of the first decade of this century, Advanced RISC Machines (ARM) emerged as the clear leader in powerful processors for mobile devices and equipment. Once one of ARM’s major founders, Apple had experience with the RISC-based CPUs from the Newton line and was devoted to ARM chips for its 2007-based iPhone. (see: AppleInsider, “How ARM has already saved Apple — twice,” 9 June 2020) Once the iPhone was out of the gate, ARM’s chip development continued to accelerate as the smartphone era had indeed come into being. Today ARM owns the mobile device market on a platform architecture level.

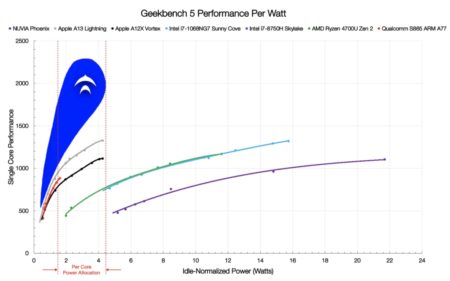

The competitive pressure to deliver more processing power and longer battery life at the same time put ARM chip progress on a steeper progress curve, destined to match and overtake Intel x86 in performance per watt. While Intel has plans to become the market leader once again—as measured in performance per watt, not just absolute performance—at the moment, Apple holds the crown to that leadership.

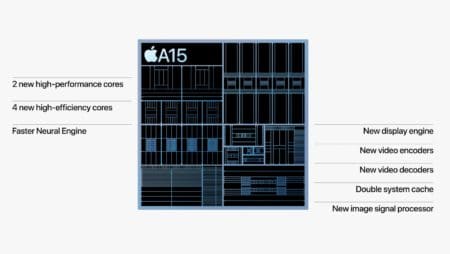

The Apple A15 Bionic is Apple’s latest SoC powering the upcoming iPhone 13 line. Remarkably, the A15 Bionic doesn’t make much progress in CPU performance over the A14. (see: SemiAnalysis “Apple CPU Gains Grind To A Halt And The Future Looks Dim As The Impact From The CPU Engineer Exodus To Nuvia And Rivos Starts To Bleed In,” 14 Sep 2021). Apple appears to have been hit by a talent exodus from its semiconductor ranks to both Nuvia and now Rivos—which we discuss below. Still, the A15 Bionic manages to increase the GPU performance over any other smartphone chip in existence (including its own A14) by 50 percent. The A14 Bionic has 15 billion transistors, just 1 billion less than the Apple M1 chip.

However, Apple is destined to face steep competitive pressure from none other than its ex-chief CPU architect Gerald Williams who left Apple in 2019 to form Nuvia. Qualcomm swiftly acquired Nuvia for 1.4 billion USD with reportedly multiple one billion-plus offers from Qualcomm rivals.

Apple largely built its world-class semiconductor design team from the ground up after acquiring PA Semi in the spring of 2007. A Forbes story makes the note that Steve Jobs wanted to ensure Apple could differentiate its new iPhone from a raft of new competition. The acquisition was a blow to Intel because they were hoping to convince Apple to build future mobile devices using its Atom processor. Why Intel failed to secure a footing in the smartphone chip market is a larger story best told on another day, but suffice it to say, their failure helped secure ARM’s dominance.

This chart from a Nuvia blog post shows very clearly Apple’s current performance per watt leadership, yet envisioned (in blue) Nuvia’s planned custom ARM-based Phoenix NUMA chip would exceed Apple. Qualcomm is hoping Gerald Williams and his team will help them beat Apple and take the performance per watt crown. (Image: Nuvia)

While Intel and AMD fought in a post-PowerPC era (Apple moved Macs to Intel in 2005), ARM quietly advanced the ARM chip architecture to squeeze every ounce of computer performance out of every watt. While many smartphone makers used largely unaltered ARM chip designs for their smartphone CPUs, Apple had a special license with ARM to develop customer ARM-based chips with proprietary logic.

As you can see from the two charts above, (second chart in this article and the chart directly above) the ARM world has caught and surpassed the Intel X86 world. New Intel CEO Pat Gelsinger says Intel will retake the performance per watt crown by 2025. Given recent history and ARM’s inherent architectural advantages, that claim seems like a risky bet. If anything, Intel (and AMD also) will face significant new competition for performance per watt from the likes of another break-out new company called Rivos Inc.

Process Technology—Intel’s Faulting

We will discuss Nuvia and Rivos in the next section. What is critical to understand now is how Intel fell behind in performance—not just to the ARM-based chips at Apple but even AMD.

Intel began to stutter in its leadership at the manufacturing level a few years ago, but things took a horrible turn for the worse in the summer of 2020 when Intel announced a significant delay in its next manufacturing milestone. Intel would now not move to 7nm process nodes for several years. This process technology has now been renamed “Intel 4” and is due in 2022 H2.

From its earliest days, Intel orthodoxy said that it could lead the world in semiconductors if its chip designers could work directly with its manufacturing engineers, something not easily done when working with chip foundries halfway around the world. That was the philosophy but not necessarily the reality. As a case in point, Dutch semiconductor equipment maker ASML—which manufactures incredibly complex lithography systems critical to the production of chips—partnered with Intel back in 2012 in order to develop extreme ultraviolet light (EUV) lithography systems for the next era of tiny chips. But ASML also partnered with Samsung and TSMC over the same technology. Today, TSMC alone is estimated to possess half of the total EUV lithography machines that exist in the world.

A photo of a final assembly of an ASML EUV lithography machine. These units cost over 150 million USD and can require up to 6 months to install before use. (Image: ASML)

TSMC’s 5nm node-based chips—like Apple’s new M1 processor in its new Macs—are entirely reliant on ASML’s EUV lithography machines, each of which costs upward of 150 million USD and can take 4-6 months to install before use. Intel’s earliest 10nm chips pursued the smaller node using conventional lithography using quad patterning, but it failed. While they have since worked out their 10nm chips, which they are shipping today, ASML’s EUV machines come into play when Intel 7nm chips ramps in the near future.

Intel’s chip manufacturing problems may ultimately stem from the attrition that comes from global specialization. Companies that try to do the whole widget themselves succumb to companies that allow other smaller companies to risk the capital to tackle specialized components that are highly competitive. In the mid-80s, Intel abandoned the RAM market because it could not compete with major Japanese rivals that poured massive capital into new factories to produce the world’s best random-access memory chips.

Now at this time, with TSMC and Samsung producing hundreds of million more chips for the smartphone market—a market much more extensive than computers—the Asian chip foundries have more capital and larger valuations. With chip fabs costing dozens of billions to build, the market leaders are obtaining a capacity to ramp new process nodes more quickly than their smaller rivals. In simple terms, they have the money to get started on new process node technology sooner.

Complicating matters for Intel, its tight-knit relation between chip design and chip manufacturing meant that when the company had trouble back in 2018 with its 10nm node ramp, it didn’t have any outside fabs to turn to. That’s because Intel chips are design-optimized for their chip-making tools, which third-party foundries don’t own. They couldn’t just go to Samsung and say, “make this design for us.”

The decades-long unique advantage Intel held by designing chips with tight linkages between its manufacturing tools only became a curse once chips shrank to levels where electricity started to behave in unexpected ways. The solutions required novel materials and redesigns and pushed Intel into an unprecedented situation.

Meanwhile, contract chip fabs in Asia worked out such issues more swiftly where standard ARM-based chip designs and custom designs from AMD, NVIDIA, and Apple did not have such linkages between their designs and the tools used to produce such chips.

AMD’s Rising Star

With Intel’s unique situation coming to haunt them in the latter years of the last decade, nearly every major rival made significant progress and captured more of the market and outright performance leadership. Intel’s primary rival in computer chips, AMD, forged ahead with brilliant new CPU chip designs manufactured in Asia.

AMD’s flagship CPU, the Ryzen 5000 series Ryzen 9, is fabricated by TSMC on a 7nm process and does not yet use EUV. Still, AMD leads the world in absolute best balance between single-core and multi-core chip performance per Geekbench results. It’s AMD Ryzen 9 5950X, 16-core CPU boasts average single-core scores of 1689 with a multi-core score of 16,681. While Intel’s 11th generation Intel Core i9-11900K boasts slightly better single-core scores (1853), at 8 cores its multi-score score is a long way off.

In essence, AMD is delivering industry-leading single-core performance with high-multi-core performance to boot. This is the kind of balanced top performance that matters significantly in the CAD industry.

next page: Nuvia and Rivos—Ex-Apple Startups

Reader Comments

Comments for this story are closed